The new year has started and is actually already in its second week, but since I was on a well-earned vacation until Monday and then had to attend a meeting of the commission for the new syllabus for the Fachakademien für Übersetzen und Dolmetschen, I really only started getting back into the swing of things yesterday.

I know that for some colleagues, there is no such things as a Christmas break, but for me it really was, and things are slow to pick back up. That is not necessarily a bad thing, though! I’d rather have a nice slow warm-up instead of jumping right into the thick of things again (although I can do that, too, I just prefer not to).

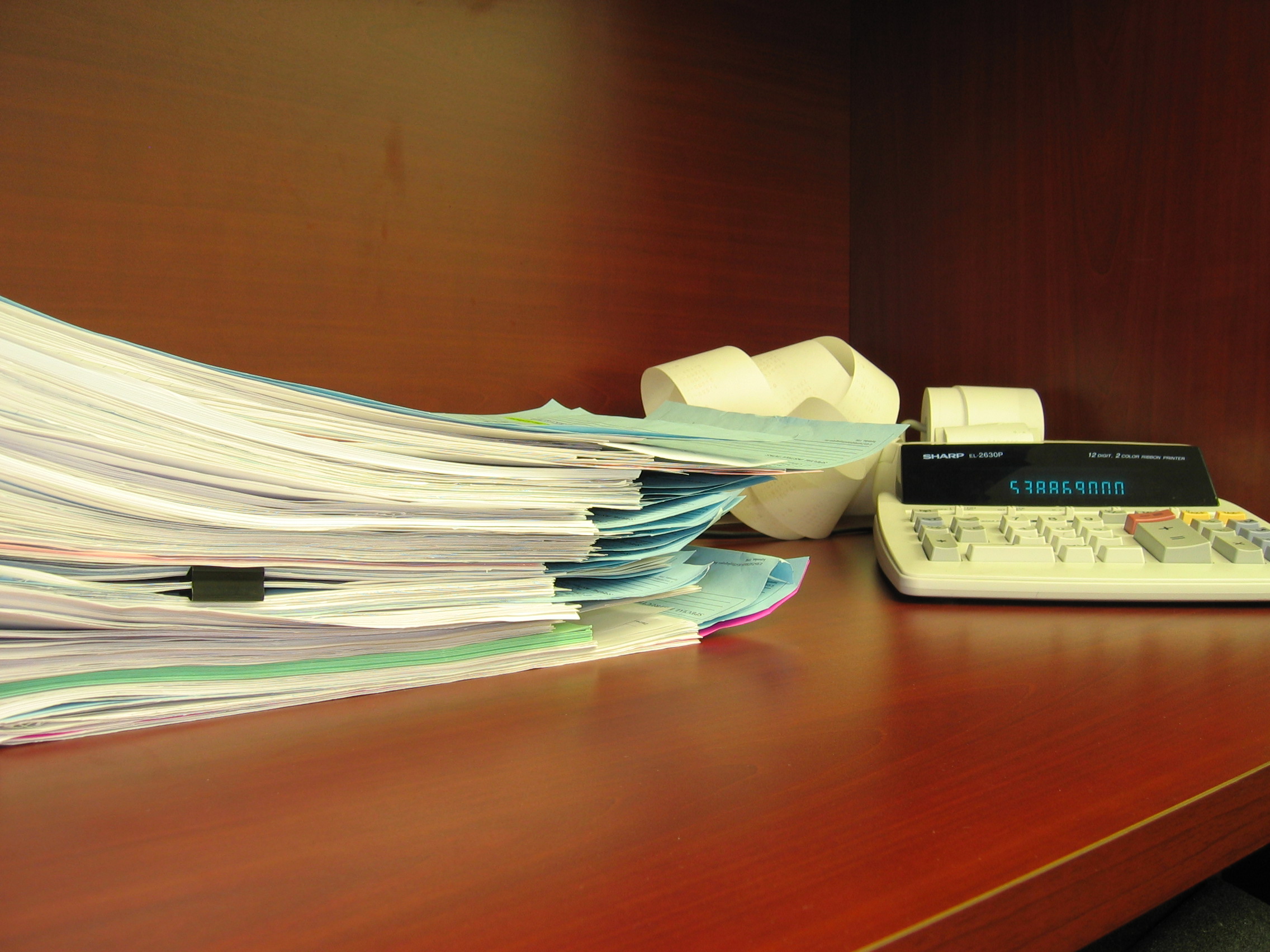

I started my work year with what most would call a necessary evil for every freelancer in Germany, the Umsatzsteuervoranmeldung or advance value-added tax return. I have to do this every quarter, but I actually don’t mind it at all.

On the one hand, it gives me an overview over how much and what kind of work I did the previous three months as well as how much money I spent and on what.

And on the other hand, it forces me to clean up my desk, in this case my multi-pocket file folder. Every piece of paper that comes across my desk gets pre-sorted into this folder, making the (final) filing a breeze. And since this takes place every quarter, there is no risk of it overflowing.

Having to do the advance return regularly also prevents me from forgetting or losing important paperwork like invoices, receipts and so on.

And the most important part, at least from a financial point of view, is of course that I won’t have this huge sum in value-added tax to pay back for an entire year come tax time.

Yes, it may be easier to just collect everything and give it to your accountant, and I do have one who does the annual tax return for me, but I like having this opportunity to see how my business is doing, and it really isn’t that much work.